chandler az sales tax calculator

The average sales tax rate in Arizona is 7695. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Chandler AZ.

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Find list price and tax percentage.

. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Method to calculate West Chandler sales tax in 2021. The average cumulative sales tax rate in Chandler Heights Arizona is 63.

The Arizona sales tax rate is currently. Cochise County 61 percent. This is the total of state county and city sales tax rates.

Within Chandler Heights there is 1 zip code with the most populous zip code being 85127. Sales Tax Calculator Sales Tax Table. Wayfair Inc affect Arizona.

85224 85225 85226. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 6300.

The Chandler Arizona sales tax is 780 consisting of 560 Arizona state sales tax and 220 Chandler local sales taxesThe local sales tax consists of a 070 county sales tax and a 150 city sales tax. Price of Accessories Additions Trade-In Value. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112.

Transaction Privilege Sales Tax. For states that have a tax rate that is less than Arizonas 56 tax is collected by the state of Arizona at the time of purchase. We continue to work with the Arizona Department of Revenue on the centralized licensing reporting and collecting of transaction privilege sales and use taxes.

Pinal County 72 percent. The current total local sales tax rate in Chandler Heights AZ is 6300. Divide tax percentage by 100 to get tax rate as a decimal.

You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code. The Chandler Heights sales tax rate is. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The sales tax rate does not vary based on zip code. How to Calculate Sales Tax.

Privilege tax is imposed on the seller for the privilege of doing business in Chandler. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Arizona has a 56 statewide sales tax rate but also has 80 local tax jurisdictions including.

Apache County 61 percent. Then use this number in the multiplication process. Gila County 66 percent.

The Chandler Arizona sales tax rate of 78 applies to the following eight zip codes. The minimum combined 2022 sales tax rate for Chandler Heights Arizona is. Groceries are exempt from the Chandler and Arizona state sales taxes.

Multiply the price of your item or service by the tax rate. Greenlee County 61 percent. Chandler in Arizona has a tax rate of 78 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Chandler totaling 22.

The Chandler Sales Tax is collected by the merchant on all qualifying sales made within Chandler. When combined with the state rate each county holds the following total sales tax. Youll have to pay state and local sales taxes on purchases made in Arizona.

The Arizona sales tax rate is currently. The average sales tax rate in Arizona is 7695. AZ Rates Sales Tax Calculator Sales Tax Table.

Places Near Chandler AZ with Sales Tax Calculator. The City of Chandler imposes a general tax rate of 15 Restaurant and Bars 18 Utility and Telecommunications 275 and Transient Lodging 29. The County sales tax rate is.

The Chandler sales tax rate is. This includes the rates on the state county city and special levels. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state.

The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. The statewide rate is 560. Tax Paid Out of State.

Chandler Heights is located within Maricopa County Arizona. Transaction Privilege Sales Tax. Did South Dakota v.

The Tax License Division administers and issues business registrations and special regulatory licenses. As of 2020 the current county sales tax rates range from 025 to 2. All privilege tax revenues are not dedicated and all go directed to the.

Gilbert 7 miles Higley 11 miles Mesa 13 miles Tempe 14 miles. Method to calculate Chandler sales tax in 2021. If you choose not to itemize on your Arizona tax return you can claim the Arizona standard deduction which is 12550 for single filers and 25100 for joint filers.

Maricopa County 63 percent. The Arizona sales tax rate is currently. SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here.

Each of these match the federal standard deduction. The minimum combined 2022 sales tax rate for Chandler Arizona is. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation districts.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Chandler AZ. Chandler 220 560 El Mirage 370 560 Fountain Hills 360 560 Gila Bend 420 560 Gilbert 220 560 Glendale 360 560 Goodyear 320 560 Guadalupe 470 560. You can find more tax rates and allowances for Chandler and Arizona in the 2022 Arizona Tax Tables.

The current total local sales tax rate in Chandler AZ is 7800. The December 2020 total local sales tax rate was also 7800. The County sales tax rate is.

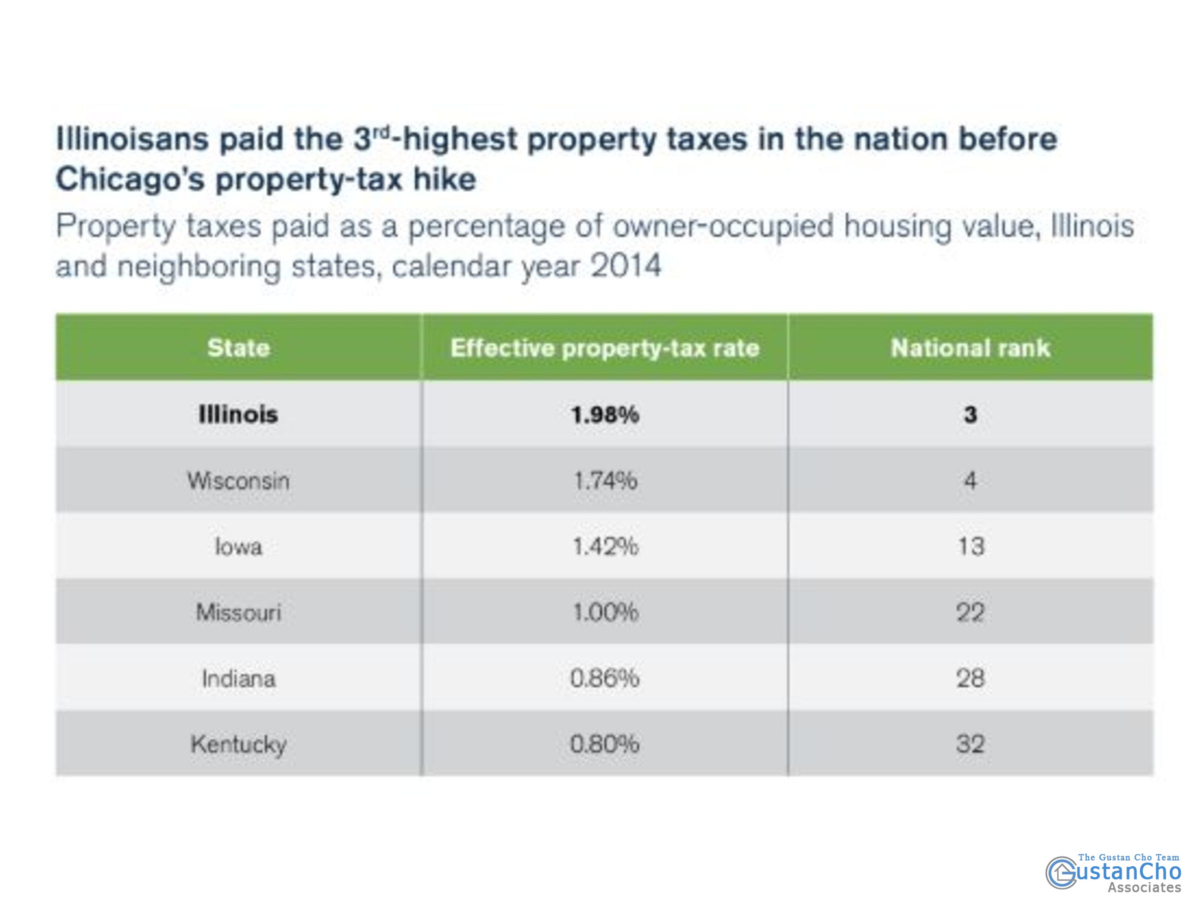

Illinois Ranked As Highest Taxed State In The Nation For Taxpayers

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

2021 Arizona Car Sales Tax Calculator Valley Chevy

Illinois Ranked As Highest Taxed State In The Nation For Taxpayers

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona Sales Reverse Sales Tax Calculator Dremployee

Rental Properties Tax Information City Of Chandler

Free Arizona Payroll Calculator 2022 Az Tax Rates Onpay

Jumbo Mortgages Thomas Gessner Loan Officer With The Bongard Gessner Team At Academy Mortgage Chandler Branch Jumbo Mortgage Finance Loans Jumbo Loans

Chandler Arizona Department Of Revenue

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Arizona Sales Tax Small Business Guide Truic

Property Taxes In Arizona Lexology

Arizona Property Tax Calculator Smartasset

Is Food Taxable In Arizona Taxjar

Arizona Sales Tax Small Business Guide Truic